Access Taxpayer Access Point for additional information, orįor refund requests prior to the most recent tax year, please complete form RPD 41071 located at RPD 41071 and follow the instructions.If you have any questions please contact the Delaware Division of Revenue. Beginning in January, we process Individual Income. How New Jersey Processes Income Tax Refunds. If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may: If your refund is in a status of Pending, please allow 10-12 weeks for it to process. Wait 12 weeks to check your refund if you filed a paper return. Paper returns or applications for tax refunds are processed within 8 to 12 weeks. For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department.Electronically filed returns claiming a refund are processed within 6 to 8 weeks. For electronically filed returns, please wait up to 8 weeks before calling the Department.Paper filed Returns: Allow 6 weeks before checking for information.

Refer to the processing times below to determine when you should be able to view the status of your refund. Please allow the appropriate time to pass before checking your refund status: E-filed Returns: Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. Keep a copy of the tax return available when checking on the refund status online or by telephone. If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. You are not required to register to use this service. A Social Security Number and the amount of the refund due are required to check on the status. Income Tax Refund Status Wondering where your refund is After submitting your return, please allow at least 2-3 weeks of processing time before checking. The status of a refund is available electronically. Learn about unclaimed tax refunds and what to do if your refund is lower than expected. These wait times are approximate and processing time can fluctuate based on additional time to correct errors. Individual Income Tax Return, visit Where's My Amended Return.

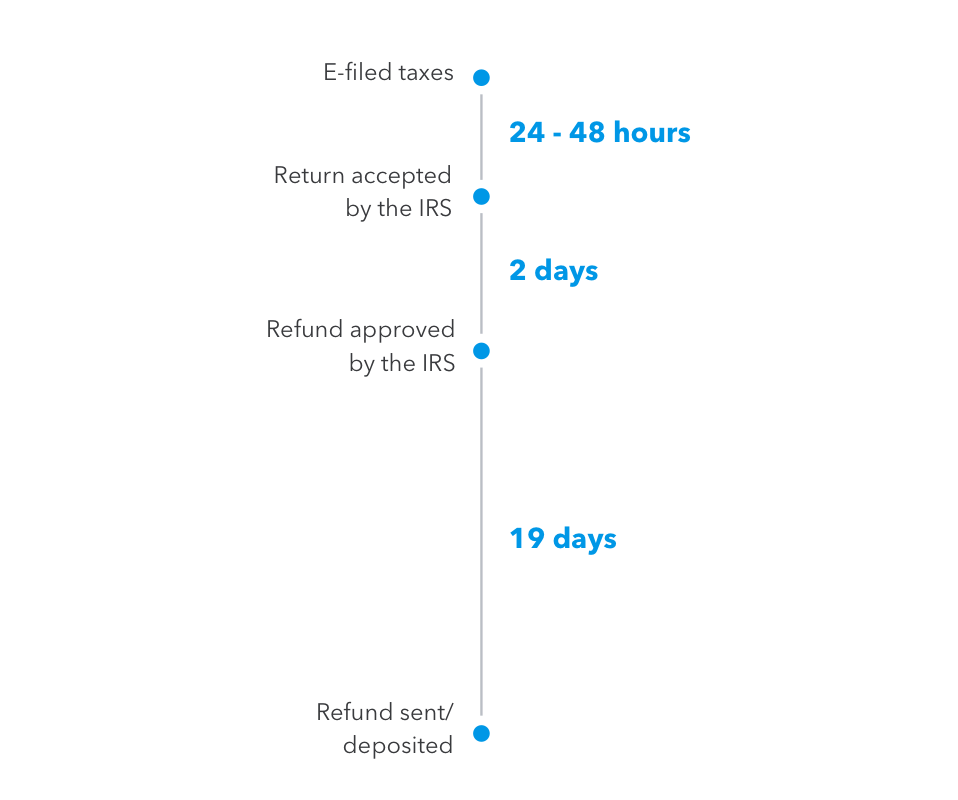

If you're looking for your refund status from a Form 1040-X, Amended U.S. When inquiring about a refund, please allow sufficient time for the Department to process the refund claim. Check the status of your tax refund here. You can check on the status of your refund: 24 hours after e-filing a tax year 2022 return 3 or 4 days after e-filing a tax year 2020 or 2021 return 4 weeks after mailing a return. The tool should return one of three statuses: 'return received,' 'refund approved' or 'refund sent.' The information typically refreshes every night. A paper return received by the Department takes 8 to 12 weeks to process. To track your refund, you'll need to know your Social Security number or Individual Taxpayer Identification Number, your filing status and the amount you're expecting.

The Department generally processes electronically filed returns claiming a refund within 6 to 8 weeks.

0 kommentar(er)

0 kommentar(er)